Cf0 financial calculator

Input CF0 -40000 CF1-7 9000 IYR 11 Offered Price. Accuracy must be entered as a.

Session 6 July 22 2014 Final Review Ppt Download

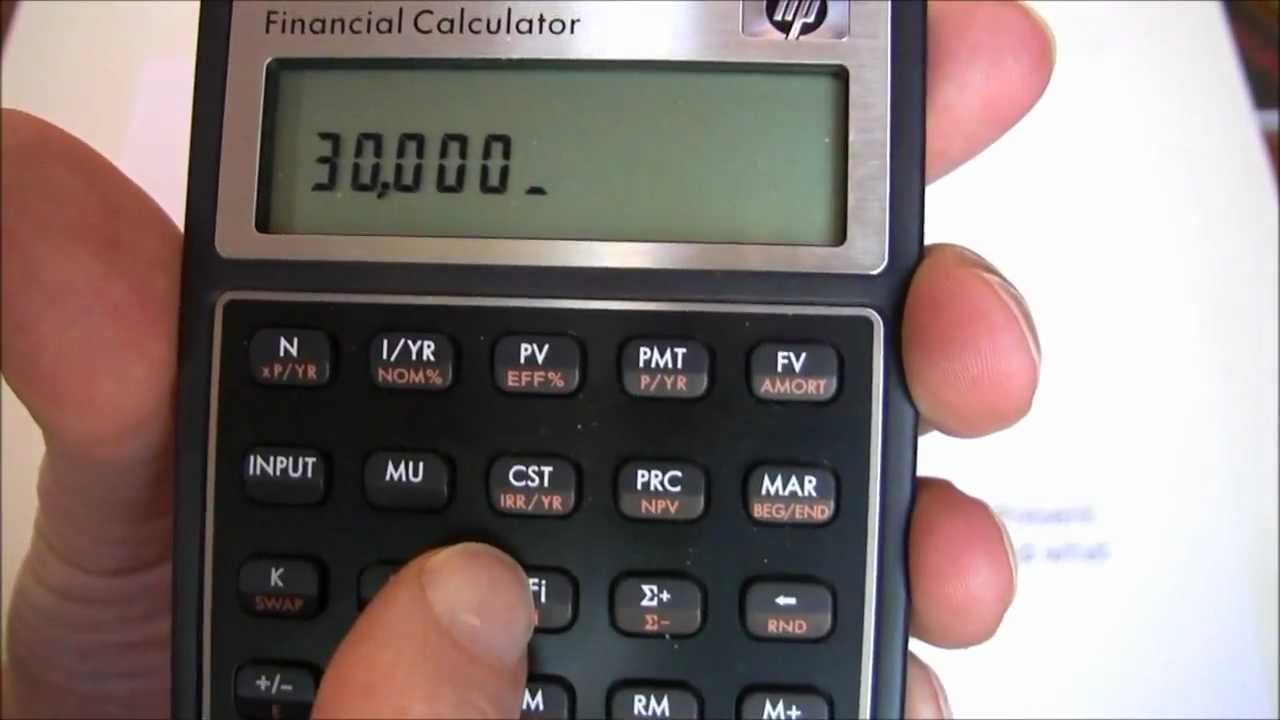

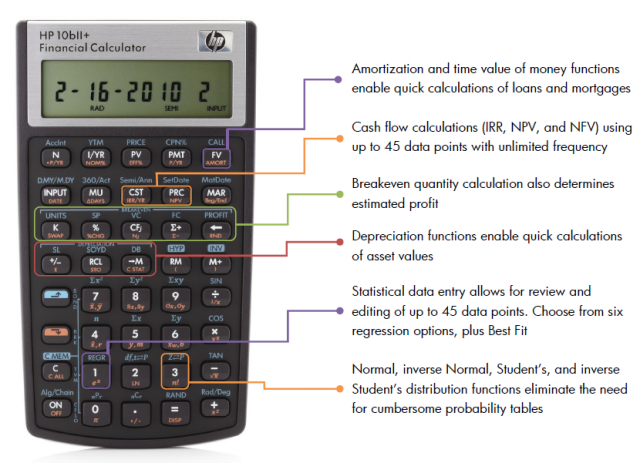

Secondary function keys The secondary functions are those printed above the primary function keys.

. Input CF0 -40000 CF1-8 9000 and then solve for IRR 1284. Enter 5 and then divide by 12. Using a Financial Calculator Tab 2.

The first investment must be entered as a negative number in cf0 up to 10 cashflows can be entered in cf1 to cf11. Basic Operation of Your Calculator 1. School George Brown College Canada.

USING FINANCIAL CALCULATOR Enter CF0 0 CO1 120 FO1 1 CO2 175 FO2 1 CO3 5070 FO3. Financial calculator method cf0 c01 f0 1 i cpt npv. Using a financial calculator.

By financial calculator input cf0 65000 co1 41000 fo1. 10172015 1219 AM Due on. X1 is always 00 x2 should be 02.

This calculator will compute a companys cash flow from operations CFO per share given the companys cash flow from operations and its total number of shares of common stock. By financial calculator Input CF0 65000 CO1 41000 FO1 1 CO2 40740 FO2 1 CO3. Press the zero button 0 Press the CFbutton this should display CF0on the TIBAII Plus.

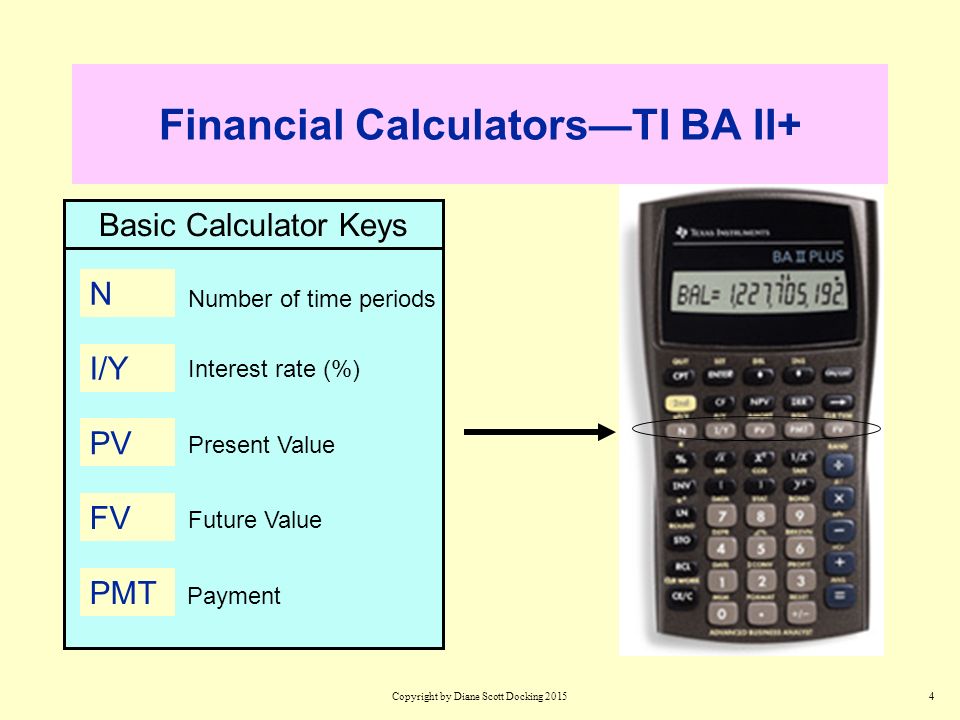

Enter 20000 and press the PV button. Enter the Loan Amount Enter the expected Number of Payments Enter the anticipated Annual Interest Rate Set Payment Amount to 0 the unknown. 10-2 Financial calculator solution.

CF0 -560 450CF1 85 471 CF2 92 150CF3 145 730 CF4 129 360CF5 188 000IYR 6 soNPV -R 32 496 32 The NPV is below zero so the. Using financial calculator press CF 2nd CEC press CF -31. Press the ENTERbutton Press to go to the next cash flow C01 Press 6 0 ENTER Press the button.

PV Costs 40000. 1500 Posted By. Press the zero button 0 Press the CFbutton this should display CF0on the TIBAII Plus.

In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time. The mathematical equation used in the future value calculator is FV PV PVi or FV PV1 i For each period into the future the accumulated value increases by an additional factor 1 i. Financial Calculator Method CF0 C01 F0 1 I CPT NPV 140000 0 579333 33 3 1 2.

Click either Calc or. Using financial calculator enter cf0 0 co1 120 fo1 1. Press the ENTERbutton Press to go to the next cash flow C01 Press 6 0 ENTER Press the button.

Assuming that your professional financial calculator is able to calculate the MIRR use the following table to indicate which values you should enter to compute the MIRR for Project X. Enter 5 and then multiply by 12. Course Title FIN 300.

School El Camino Community College District. The result is 41666667 and then press the i button. Using the CF key of your financial calculator determine.

School University of Michigan. View the full answer. The result is 60 and then press the N.

Using The Financial Calculator Ppt Video Online Download

Ba Ii Plus Cash Flows 2 Capital Budgeting Npv Youtube

How To Use A Financial Calculator To Find Pv Clearance 51 Off Www Ingeniovirtual Com

13 Free Financial Calculator Apps Websites In 2022 Free Apps For Android And Ios

How To Use A Financial Calculator To Find Pv On Sale 55 Off Www Ingeniovirtual Com

Hp 10bii Financial Calculator Npv Calculation Youtube

Ti Ba Ii Plus Npv Calculation Youtube

How To Use A Financial Calculator To Find Pv Clearance 51 Off Www Ingeniovirtual Com

Cash Flow Cf Net Present Value Npv And Irr Function Baii Plus Financial Calculator Tutorial Youtube

Chapter 8 Introduction To Capital Budgeting Business Finance Essentials

Ti Baii Tutorial

Ba Ii Plus Cash Flows 2 Capital Budgeting Npv Youtube

Present Value Of Cash Flows Calculator

Ti Baii Plus Tutorial Uneven Cash Flows Tvmcalcs Com

How To Use A Financial Calculator To Find Pv Clearance 51 Off Www Ingeniovirtual Com

Hp12c Icon Hp 12c Tutorial

Net Present Value Calculator