Annuity withdrawal tax calculator

Upon maturity of the NPS account one can only withdraw 60 of the amount and this is entirely tax-free. Annuities tend to have complicated tax and withdrawal rules.

Retirement Savings Spreadsheet Spreadsheet Savings Calculator Saving For Retirement

However the annuity income is taxable as per the investors income tax slab rate in.

. Deferred annuities take years to payout as the tax-free annuity grows with interest. In addition to potential surrender fees the IRS also charges a 10 early withdrawal penalty tax if the annuity-holder is under the age of 59 ½. Each annuity product can have many different rules laid out in their respective contracts and it is up to each investor to make sure they are.

Early Withdrawal Calculator Terms Definitions. What Is A Guaranteed Lifetime Income Rider Or Guaranteed Lifetime Withdrawal Benefit. Use this annuity tax calculator to compare the tax advantages of saving in an annuity versus a taxable account.

PaymentWithdrawal Amount This is the total of all payments received annuity or made loan receives on the annuity. 401k A tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code. If you return the cash to your IRA within 3 years you will not owe the tax payment.

Spending a few minutes contemplating the results of this calculator can lead you to make an educated decision resulting in thousands more saved at retirement. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. Annuity payment options depend on the type of annuity purchased.

The typical timeframe for receiving cash from an annuity is four weeks. Retirement Savings Calculator - Estimate how much you can save by the time you retire. Payout schedules determine the duration of.

Present Value Of Annuity Calculator Terms Definitions. Canadians aged 71 must convert their LIRA into a LIF. Money in a pension cannot normally be accessed until age 55 rising.

401K and other retirement plans. 7000 before tax and after tax. To see what your guaranteed annuity income could look like with the features.

Weve planned it such that your overall income over time will increase at rate of inflation of 2. The 40 that is used to buy an annuity is also tax-free. The time it takes to receive money from an annuity often depends on the company you are dealing with.

Fixed Deferred Annuity Calculator. This tax-advantaged status however also opens you up to a 10 penalty if you need to withdraw from your annuity before age 59 ½. This is a stream of payments that occur in the.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows growth based on regular deposits. Annuity Calculator - Like the Retirement Withdrawal Calculator except that you enter the years you want the nest egg to last and it calculates the withdrawal amount.

Disadvantages of a Fixed Index Annuity Limit of potential gains. 401k Calculator - Estimate how your 401k account will grow over time. Income annuities can provide the confidence that you will have guaranteed retirement income for life or a set period of time.

Your estimated annual annuity income will be. 4 ways to help you extend your savings. Under this agreement equal withdrawal payments can begin prior to the annuity owners age of 59 ½ without.

The present value is given in actuarial notation by. Use this income annuity calculator to get an annuity income estimate in just a few steps. Simply enter your age income start date and amount to invest in our Annuity Quote Calculator and click the Get My Quote button.

Present value is linear in the amount of payments therefore the present. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. You can customize your annuity to meet your needs.

Your quote will appear instantly on the next page. You can set the guarantee period index the income to help it keep pace with inflation or include your spouse in a joint plan. Non-Qualified Annuity Tax Rules.

Page 1 of 1. Where is the number of terms and is the per period interest rate. Immediate annuities can payout within a year of purchase.

Annuity A fixed sum of money paid to someone typically each year and usually for the rest of their life. Following are the tax rules for NPS withdrawal. Also known as the LIF Payout Schedule by the Canada Revenue Agency CRA.

Interest earned in your annuity compounds tax-free until you begin making withdrawals which means your value can grow at a far faster rate. Best time of the year to retire for tax purposes. The income rider is typically an optional feature on fixed indexed and variable annuities and serves as an alternative to annuitization.

3 min read. Other annuity contracts may allow the withdrawal of the gains not principal. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

Use our emergency tax calculator to see how much tax might be deducted from your pension withdrawals under emergency rate tax. Many clients purchase income annuities to help cover their essential expenses as defined by them in retirement. Use our 2021 LIF minimum withdrawal rates calculator or view the 2021 LIF minimum and maximum withdrawal rates table.

Based on your effective tax assumption of 15 your annual after-tax income is. The annuity income rider is an optional benefit that functions like a pension in that the rider will distribute a guaranteed income for life to a retiree. However future withdrawal amounts will largely depend on whether your investments meet your long-term growth assumption of 6.

Taxation of NPS withdrawal amount upon maturity. A tax-qualified annuity is one used for qualified tax-advantaged retirement plans such as an IRA or 401k.

Income Tax Calculator Calculate Income Tax Online For Fy 2021 22 Fy 2022 23 Max Life Insurance

Annuity Taxation How Various Annuities Are Taxed

Annuity Calculator

Taxtips Ca Rrsp Rrif Withdrawal Calculator

Retirement Savings Spreadsheet Spreadsheet Saving For Retirement Stock Trading Strategies

Retirement Withdrawal Calculator For Excel

Is Charity Care Considered Forgiven Debt

How To Pay Zero Income Tax With Tax Rebate Income Tax Calculation Examples Youtube

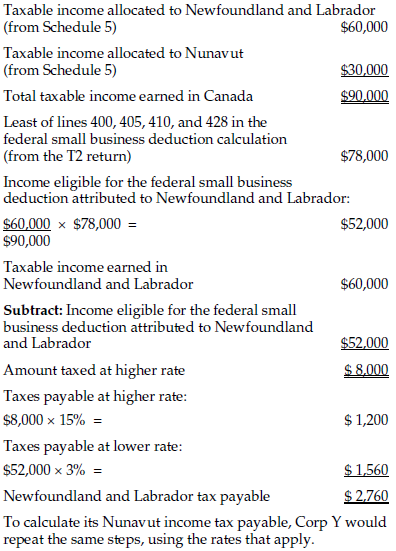

Dt Max Schedule 5 Tax Calculation Supplementary Corporations

/GettyImages-1327236972-5c9b68205a7740488795ef88af30ebfe.jpg)

How Capital Gains Tax Works On Pension Funds

Retirement Calculator Spreadsheet Budget Template Retirement Calculator Simple Budget Template

Simple Tax Refund Calculator Or Determine If You Ll Owe

Hand Count Money Stock Illustrations 1 027 Hand Count Money Stock Illustrations Vectors Clipart Dreamstime

Understanding Maximum Transfer Value Rules Advisor S Edge

Annuity Taxation How Various Annuities Are Taxed

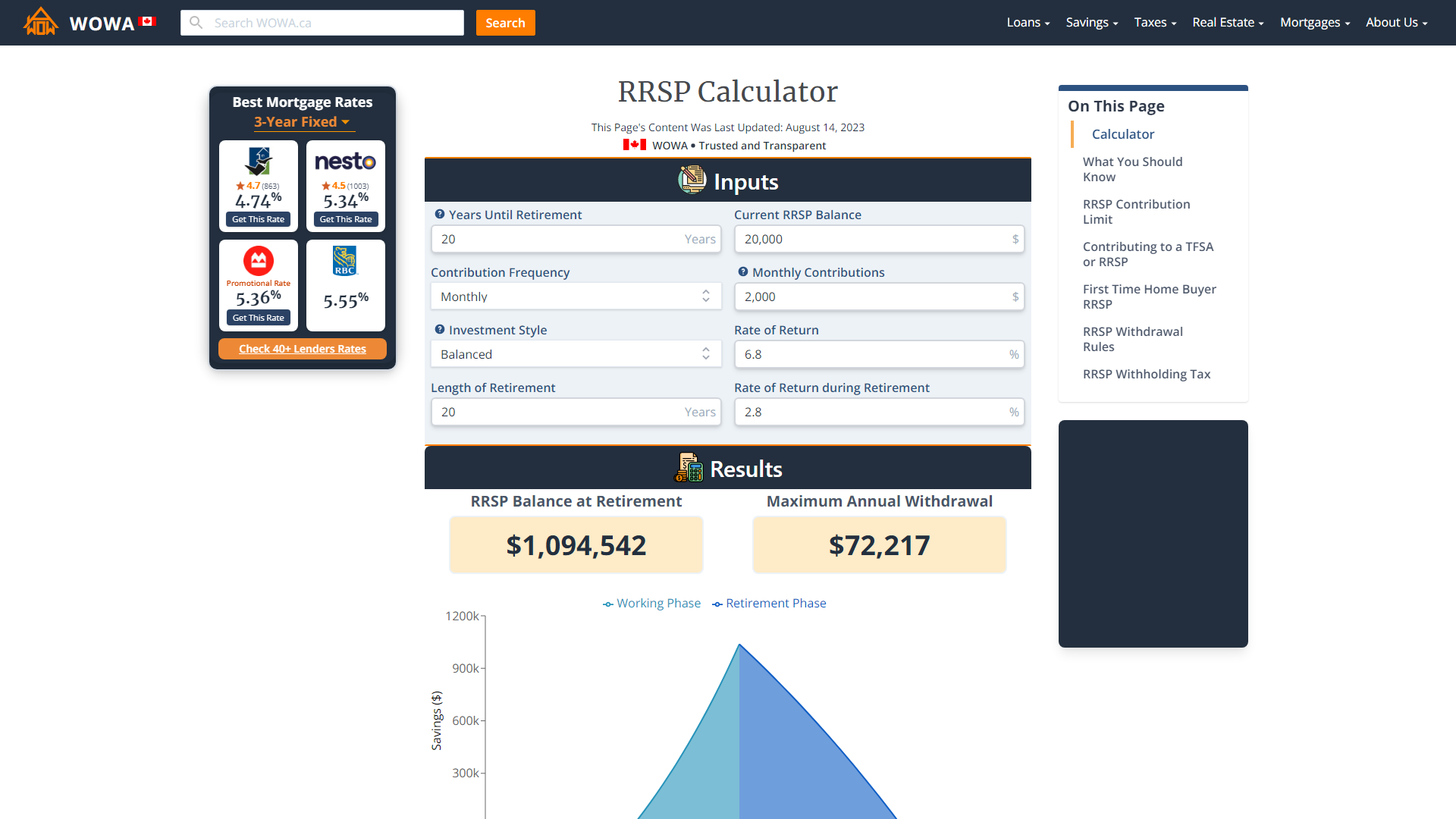

Rrsp Savings Calculator Wowa Ca

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20